In Currency trading if you learn the above as a novice you can increase your chances of financial success and if you are trading already it can make your existing forex strategy more popular.

Lets look at how to apply the 80 – 20 rule in currency trading and make triple digit annual gains.

Definition

The 80/20 rule was developed by Italian economist Vilfredo Pareto to describe the unequal wealth in his country.

He noted that 20 percent of the people owned 80 percent of the wealth.

The 80 / 20 rule has been applied in other areas and is very applicable to profitability.

Lets look at its significance in general business terms and then apply it to financial currency trading.

Often 80% of a company’s sales will come from only 20% of their key clients.

The point of the Pareto principle is to suggest that you focus your energy on the 20 percent that really matters and if you think about it makes total sense – you focus on where the profit potential is best

The 80 / 20 Rule applied to Currency trading

One of the reasons most novice traders lose is they trade to much – they think that if their not trading their missing an opportunity, this is typical of forex day traders, who think they can win trading frequently, they can’t and never do.

Other traders trade on emotion and news and again get hammered.

There is absolutely no correlation between how often you trade and your forex profits, in fact the LESS you trade can lead you to currency trading success.

How To easily make triple digit gains

Look at any currency chart and how often do you see a really big move - that’s one that is a strong sustained trend, with very few or small retracements?

About half a dozen times a year across the majors.

If you took the 80 / 20 rule and applied it to currency trading you would come to the conclusion that these are the trades that make the most money and are the ONLY ones you need to hit to make spectacular gains.

So you trade less but you make a lot more.

Sounds simple?

It is - yet very few currency traders are able to apply the rule and never adapt their forex strategy to take advantage of it.

If you do, you can make more profits with less risk and spend less time executing your trading signals.

Focus on hitting the really big trends and a clue to finding them is, they normally take place from new market highs.

Look for valid resistance that is strong and been tested numerous times, is considered significant and then trade the breakouts that occur.

Risk as much as you can only these trades.

Do it and adapt your forex trading system to do this, you will achieve currency trading success and triple digit regular annual forex gains will be a realistic objective

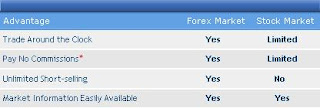

The Forex market can be described as a non-centralized market where there is no common marketplace for the traders.

The Forex market can be described as a non-centralized market where there is no common marketplace for the traders.

The whole idea of cutting and pasting the last X amount of closing prices then calculating which way the trend is can easily be found in a number of different indicators and methods. Seeing recently what TopGun Software can compute and graphically present, for instance, their one of a kind FX Multimap can instantly show you the strength of a pair or an individual currency vs all other currencies. Flips of this Multimap from red to green usually indicator a change of direction or resumption of a previous upward trend. Either way, weakness is disappearing and strength is continuing and this is shown to you in an instant and you did nothing except add this indicator to your chart. Another great thing about Topgun is the recent Narrow Range Breakout Script that intuitively adds lines above and below the levels of important ranges. Used in concert with flips of FX MultiMaps from green to red or red to green, a successful trade becomes all the more likely. Forex Killer could NEVER give you such amazingly simple indications of when to enter a trade. Exiting a trade is just as simple if you just add a trailing chandelier stop. It’s hard to do much of anything with Forex Killer except identify how likely a trade is to go up, but if you took any sort of Forex education, you’d probably hear at some point that you ought not trade on what you think “might” happen, rather, trade based on what you see is happening. TopGun has scores of other indicators I am just learning about, so I’ll keep you updated on this software of the next few months.

The whole idea of cutting and pasting the last X amount of closing prices then calculating which way the trend is can easily be found in a number of different indicators and methods. Seeing recently what TopGun Software can compute and graphically present, for instance, their one of a kind FX Multimap can instantly show you the strength of a pair or an individual currency vs all other currencies. Flips of this Multimap from red to green usually indicator a change of direction or resumption of a previous upward trend. Either way, weakness is disappearing and strength is continuing and this is shown to you in an instant and you did nothing except add this indicator to your chart. Another great thing about Topgun is the recent Narrow Range Breakout Script that intuitively adds lines above and below the levels of important ranges. Used in concert with flips of FX MultiMaps from green to red or red to green, a successful trade becomes all the more likely. Forex Killer could NEVER give you such amazingly simple indications of when to enter a trade. Exiting a trade is just as simple if you just add a trailing chandelier stop. It’s hard to do much of anything with Forex Killer except identify how likely a trade is to go up, but if you took any sort of Forex education, you’d probably hear at some point that you ought not trade on what you think “might” happen, rather, trade based on what you see is happening. TopGun has scores of other indicators I am just learning about, so I’ll keep you updated on this software of the next few months.